Put Visa's Order Insight to Work for Your Business

In today’s world, credit card fraud and chargebacks are an inevitable part of running a business. Visa has estimated that their cardholders initiate over 3 million disputes per year because they can’t recognize the specific transaction in question. Thankfully, there are ways to eliminate most or even all of these issues and MobiusPay along with Visa’s Order Insight offers the tools to help - with surefire methods to earn your customer’s trust and keep consumers happy while not taking a hit from fraudsters online at the same time. Order Insight is designed to combat fraud in a more streamlined manner than traditional chargeback alerts. By connecting issuers and merchants with the combined goal of reducing disputes that are not really disputes.

Initially launched by Verifi in 2017 before it was purchased by Visa, Order Insight is a tool that helps merchants to avoid chargebacks and get real-time fraud notifications. It enables Visa merchants with the ability to respond to cardholder inquiries around unrecognized transactions and other potential disputes by providing supplemental merchant information, in close to real-time. Simply put, Order Insight was created to address a specific point in the dispute process: the cardholder informing their bank that they wish to dispute a transaction. Visa’s Order Insight tool offers these important key features:

- Provide key information to both issuers and cardholders at the point of investigation.

- Stifle chargebacks and dispute losses from occurring.

- Receive real-time fraud notifications.

In recent years, Visa has seen millions of chargebacks initiated because cardholders did not recognize the transactions. In addition, 20% of all chargebacks were tied to purchases of digital goods, which includes electronic downloads of movies, music, and phone application purchases. As the number of transactions related to digital goods continues to increase, so does the potential for an increased number of disputes. And this can be expensive, as the cost of working a dispute can be far greater than the purchase itself. Merchants and issuers need a more proactive way to prevent a dispute from occurring if a cardholder does not recognize the transaction. While digital goods merchants are certainly important due to the volume, use cases exist for ALL merchants looking to reduce dispute volume, including brick and mortar merchants, travel and entertainment merchants and online merchants.

The last chance a merchant has to stop a chargeback from happening is when the cardholder is on the phone with their bank asking for one. Unfortunately, the merchant is very rarely involved in these conversations. While the bank may try to guide cardholders toward investigating an unfamiliar transaction on their end or resolving a product complaint directly with the merchant, they do not always have enough information to prevent every invalid chargeback. With Order Insight, the merchant’s fate is not determined by how diligent and persuasive the issuers’ customer service representative is about handling chargeback calls. The issuer will have a pipeline directly into the cardholder’s transaction history with the merchant, and can provide specific and detailed information to cardholders who don’t recognize a transaction—as well as those who are hoping to pull off a friendly fraud chargeback. Used effectively, Order Insight can reduce chargebacks that would have otherwise resulted from merchant error, friendly fraud, and true fraud.

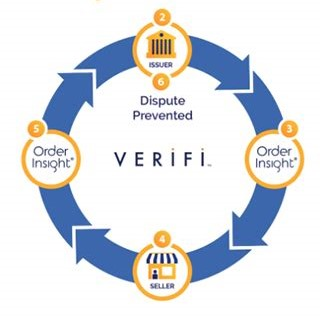

The first step in getting started with Order Insight is to understand how it works. The process works as a plugin for the Visa Resolve Online platform and allows merchants to seamlessly share information through VROL to the issuer, and in its simplest terms works like this:

The customer contacts the issuer with a dispute over a transaction, and then the issuer sends a request for the order information. The data-sharing network processes the information and sends a request to the seller involved. After being contacted, the seller sends the order data to the overseeing organization, and they pass along the details to the issuer. After reviewing the information with the customer, the issuer can help prevent a dispute. Keep in mind; all of this happens without any manual effort from the merchant; it is a simple matter of integrating the MobiusPay API and allowing our backend systems to do the rest on your behalf.

With any card transaction, there is a certain amount of data available to all or most of the parties involved. Not all this information may be transmitted though as concerns about efficiency or privacy can mean that only partial information gets transmitted between banks, merchants, and card schemes. The catch is that much of the detailed data integral to chargeback resolution will not be transmitted. Order Insight solves this problem by providing all the details related to the transaction.

If a customer disputes a charge, these additional transaction details are often the compelling evidence you need to justify the purchase. Now, thanks to Order Insight, the system will automatically transmit this information in response to the initial customer inquiry or complaint. To demonstrate, let’s assume a buyer completes a purchase, but later contacts the issuing bank, claiming not to recognize the transaction. In the past, this would have likely resulted in a chargeback under the legacy system. But with Visa Order Insight, the process begins with a transaction inquiry. The bank can use the system to recall critical information quickly and efficiently, giving the buyer a key context for the purchase and preventing the chargeback.

Once implemented, there are many ways Order Insight can benefit your business:

- REDUCE CHARGEBACK RATES - Order Insight is estimated to stop up to 64% of disputes from becoming chargebacks. This could have a significant impact on your chargeback-to-transaction ratio, helping you reduce the risk of threshold breaches.

- RETAIN MORE REVENUE - Order Insight resolves disputes without sacrificing revenue. Once a customer recognizes and understands the charge, a credit is no longer necessary. This means Order Insight has a high return on investment (ROI).

- TAKE QUICK ACTION - With Order Insight, you will know about a customer complaint within seconds. Without Order Insight, you will not know there is a problem until you receive the chargeback — which will come 2-5 weeks after the dispute. Identifying issues early means you can solve problems quicker and prevent more disputes from happening.

- SAVE FULFILLMENT COSTS ON DISPUTED ORDERS - Often, a customer will dispute a purchase before you have fulfilled it. Since Order Insight alerts you to disputes in real time, it is possible to stop fulfillment before the products go out. This means you can retain fulfillment, shipping, and product costs.

- IMPROVE THE CUSTOMER EXPERIENCE - By being more responsive and supportive, you will improve the customer experience and increase perceived value.

Order Insight is a powerful collaboration tool that can help merchants prevent a wide range of chargebacks. While it can be highly effective, it is still only one tool that can only address one cardholder touchpoint in the long journey through which a transaction becomes a chargeback. For the best protection, tools like Order Insight should be supplemented with complementary products and practices that will allow you to fight chargebacks at other points in the dispute cycle.

The fastest, easiest, and most effective way to get started is through a Visa-authorized facilitator like MobiusPay, who will integrate with the platform on your behalf. In most cases, you will only need to provide basic merchant account details; we will handle all the other complex details of your integration process for you.

Whether you are a merchant and considered low-risk or high-risk by your bank or payment processor, Order Insight will be of great assistance to your business. Contact MobiusPay today for more information!

Return to Blog

* Created by