Using Cryptograms & Network Tokens to Secure Recurring Revenue

In the high-risk payment landscape, hearing words like "token" or "cryptogram" often leads to a quick assumption: we must be talking about cryptocurrency or the blockchain.

However, such assumptions aren’t the entire story. In fact, when it comes to securing recurring revenue and boosting approval rates, the reality is quite different, and far more established.

We aren't talking about Bitcoin or digital wallets. Nope.

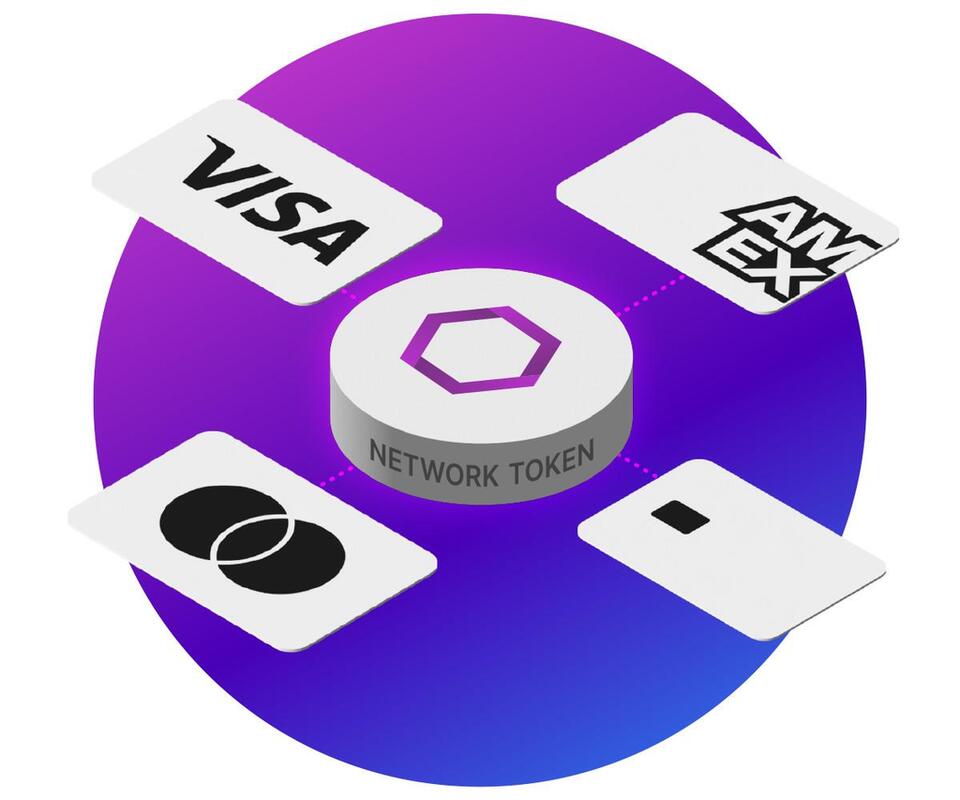

Instead, we are talking about the advanced security infrastructure embedded deep within the Visa and card scheme networks.

For years, streaming giants like Netflix utilize specific technologies to ensure their millions of monthly subscriptions processed smoothly without triggering false fraud alerts. They needed a way to prove a transaction was authentic, secure, and recurring, without the issues that usually cause declines. That technology involves Network Tokens and Transaction Cryptograms.

At MobiusPay, we know that for operators in the adult and high-risk space, a declined transaction isn't just a technical error; it’s lost revenue you fought hard to earn.

Today, the good news for merchants is that the technology that powers the world's largest subscription services is available to you.

Here is how these cryptograms work and why they are essential for stabilizing your recurring billing.

What is a Transaction Cryptogram?

First, let’s get down to the basics and understand what the value of this technology is. We’ll do that by going under the hood.

A transaction cryptogram is a unique, dynamic code generated for a single, specific payment event.

It serves as a digital signature that verifies the authenticity of the transaction. Because this code is mathematically bound to the specific details of that moment, it is valid only for that one transaction.

And that’s great for fraud prevention. Let’s look at how.

If a hacker were to intercept this cryptogram, it would be useless to them. They cannot use it for a future purchase or a different merchant because the "key" changes every time.

This process is entirely separate from the blockchain.

Instead, it is a core component of Visa’s existing security infrastructure which is designed to validate that the person initiating the charge is the legitimate cardholder (or authorized merchant, in the case of recurring billing).

How It Works: The Data Composition

The cryptogram isn't just a random number. It is generally generated using a precise combination of three data points:

- The Network Token: This replaces the sensitive Primary Account Number (PAN) with a non-sensitive identifier.

- Token-Related Data: Specific metadata associated with the token's issuance.

- Transaction Data: Details unique to the purchase, such as the amount and date.

With all this taken into account, the card networks can now verify the transaction's legitimacy with a much higher degree of confidence than a standard card-on-file transaction.

The Lifecycle Advantage: Why Tokens Beat Card Numbers

Beyond just security, there is another massive operational benefit to this technology. We have to talk about the "shelf life" of the data you are storing.

In the old model, you stored a Primary Account Number (PAN). That is the 16-digit number on the front of the customer's card. The problem with PANs is that they are fragile. They expire every few years. They get lost. They get stolen and reissued.

When any of those things happen, your recurring billing fails.

You are then forced to chase the customer to update their payment info. Often, they don’t bother replying, and you lose a subscriber who actually wanted to pay you. This is called involuntary churn, and it is a silent killer for high-risk businesses.

Network tokens change this dynamic completely.

Because the token is issued by the card brand itself (like Visa or Mastercard), it maintains a direct link to the underlying bank account, not just the plastic card.

If a customer gets a new physical card sent to them in the mail, the Network Token you hold on file can be automatically updated in the background. You don’t need to call the customer. You don’t need to ask for new numbers.

The token simply continues to work.

This means your recurring revenue stream becomes much more resilient. You stop losing money to expired cards, and you keep your customer lifetime value (LTV) high without lifting a finger.

The Result: Higher Throughput and Account Stability

So, why does this matter to you?

Historically, this level of sophisticated data exchange was reserved for the giants.

Companies like Netflix have massive teams dedicated to squeezing every percentage point out of their approval rates. They used network tokens and cryptograms to ensure that when a monthly subscription hit, the bank said "yes."

But the landscape has shifted. Now, we have access to this same infrastructure.

For operators in the adult and high-risk space, this is a game changer for two critical reasons.

First, it attacks the number one enemy of recurring revenue: the false decline. This is where a legitimate customer gets rejected simply because the issuing bank feels "unsafe" about the transaction. Because the cryptogram provides cryptographic proof that the transaction is valid and the data is secure, banks are far more likely to approve it.

Second, and perhaps more importantly, this technology helps protect your Merchant Account from termination.

In our industry, high fraud ratios are the fastest way to an account shutdown. By using cryptograms to authenticate transactions, you drastically lower the risk of fraud. This keeps your chargeback ratios low and your processing lines stable.

The result is better throughput on recurring transactions and a safer, more sustainable business model. You keep your customers longer, and you keep your MID healthy.

This is excellent feedback. It makes the article actionable rather than just theoretical.

One quick technical clarification to keep you looking sharp: Your team member's notes are 90% right, but we need to be careful with the phrasing "store card data as cryptograms."

- The Correction: You don't store the cryptogram (because the cryptogram expires after one use). You store the Network Token. The Token generates a new cryptogram for every single transaction.

I have written the new section below. I titled it "How to Implement This for Your Business" and placed it logically before "The Result."

Here is the draft for the new section.

How to Implement This for Your Business

If you are ready to move away from fragile card numbers and onto stable Network Tokens, the process is less about coding and more about asking the right questions.

Since this technology relies on the card networks (Visa/Mastercard) speaking to your bank, you need to ensure your partners are fluent in this language.

Here is your checklist for getting started:

- Ask Your Gateway: "Do you support Network Tokenization?" Your payment gateway is the "Token Requestor."

They are the ones who will take the sensitive card data you currently have and exchange it with Visa or Mastercard for a secure Network Token. If they don't support this feature, you cannot use it.

- Ask Your Acquirer: "Are you set up to receive Network Tokens?" This is the second half of the puzzle.

Even if your gateway can get the token, your acquiring bank must be able to process it. Both sides need to be aligned.

- The "Swap" Process Once both partners say "yes," the transition begins. You won’t be storing cryptograms (which are one-time-use codes); instead, you will replace your stored credit card numbers (PANs) with Network Tokens.

From that point on, whenever you run a transaction, the Token will automatically generate a fresh, unique cryptogram for that specific moment. You get the security of a dynamic code with the simplicity of a stored file.

Partnering for Success

At MobiusPay, we understand that you need every edge you can get to keep your business running smoothly.

We have the partnerships to implement these advanced solutions for your business.

If you are looking to stabilize your recurring billing and access the same tools the big players use, get in touch with us.

Return to Blog

* Created by